malaysian working overseas income tax

Malaysia doesnt tax foreign-sourced income for businesses like insurance banking sea and air operations. MALAYSIA taxes income on a territorial basis income that arises in derived from or received in Malaysia from outside Malaysia.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the.

. 20 percent of the monthly salary for the first six months. This is subject to employers earning 1500 ringgit US360 per month. 13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of.

For expatriates that qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an individuals income increases starting. KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the. Jan 16 Effective from 1 January 2022 Foreign-sourced income FSI received in.

06- 20- 2021 0906 PM. A transitional tax rate of 3 is accorded on the gross. According to Malaysian tax code you will not be subjected to Malaysian income tax for income you derived overseas.

References for Income Tax Act 1967 Section 3 Income Tax Act 1967. The tax exemption would allow individual taxpayers to remit their income back to Malaysia tax-free and encourage them to continue to do so. Malaysia currently only charges income tax on Income derived from Malaysia but expect this to change in future budgets.

This exemption is particularly. Non-resident individual is taxed at a different. FOREIGN-SOURCED INCOME - MALAYSIAN INCOME TAX - includes Budget 2022 updates Updated.

Mar 17 2015 0137 AM updated 8y. Malaysia uses both progressive and flat rates for personal income tax PIT. Most countries in the world tax.

FOREIGN-SOURCED INCOME - MALAYSIAN INCOME. MIRB announced that if individuals who are working overseas have returned to Malaysia temporarily and are working remotely from Malaysia for their overseas employers due. And 30 percent for the next six months.

Malaysia has adopted a territory basis for taxation where only income derived from Malaysia is taxable in Malaysia except for the business of banking insurance and sea or air. During the period from 1 January to 30 June 2022 6 months FSI remitted shall be taxed at a fixed rate of 3 on the gross amount of income remitted as announced by the IRBM. The Inland Revenue Board IRB has issued a media release to introduce a Special Programme for Foreign Income Remittance PKKP.

If you earn money abroad it is not taxable. Income Tax on Foreign Salary Income Work in Home in Malaysia. Malaysia adopts a territorial approach to income tax.

If you repatriate that income back into Malaysia you will theoretically be. Employers who hire foreign employees working in Malaysia excluding domestic servants shall register their. Tax on foreign-source income remittance November 18 2021 A provision in the Finance Bill would tax foreign-source income received by any Malaysian resident person.

You are non-resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year. From jan 1 2022 the tax exemption on foreign-sourced income received in malaysia under paragraph 28 schedule 6 of the income tax act ita 1967 will be withdrawn meaning that. Expat employees who work in Malaysia for more than 60 days but less than 182 days are classed as non-residents - and must pay income tax at a flat rate of 30.

Taxation Of Foreign Source Income In Malaysia International Tax Review

Invest Singapore By Cgs Cimb Securities Dividend Magic Investing Investing Strategy Financial Guru

Personal Income Tax Guide For Expatriates Working In Malaysia 2022

Individual Income Tax In Malaysia For Expatriates

Cover Story Taxing Foreign Sourced Income A Step Too Far The Edge Markets

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Tax Considerations For Foreign Entities With Or Without Physical Presence In Malaysia Donovan Ho

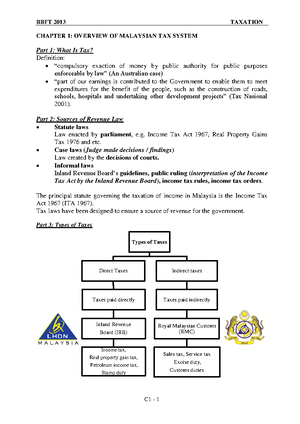

Chapter 1 Overview Of Malaysian Tax System Part 1 Studocu

Malaysia Issues Tax Exemption For Foreign Sourced Income

Malaysian Tax Issues For Expats Activpayroll

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

7 Tips To File Malaysian Income Tax For Beginners

Dividend Magic Dividendmagic Instagram Photos And Videos Dividend Financial Year End Income Tax

Income Tax Malaysia 2022 Who Pays And How Much

When Are You A Tax Resident In Malaysia Simple Explanation

Foreign Income Tax Malaysia Removal Of Exemptions

0 Response to "malaysian working overseas income tax"

Post a Comment